Supreme Court keeps pressure on utilities burning Wyoming coal

FROM WYOFILE:

Majority opinion declined to halt EPA rules mandating drastic carbon dioxide emission reductions, likely resulting in coal plant closures.

Wyoming’s fight to extend the life of its coal industry will continue without a reprieve, after losing a legal appeal that leaves in place federal deadlines for coal-burning utilities to either drastically cut greenhouse gas emissions from aging facilities or close them altogether.

The U.S. Supreme Court last week declined to impose an emergency stay on the U.S. Environmental Protection Agency’s power plant rules, leaving legal challenges to play out in lower courts where Wyoming and many other states still hope to stop the rules or drastically modify the carbon emission reduction targets.

“While it’s disappointing the Supreme Court declined to immediately halt this overly expansive and unlawful rulemaking that directly attacks Wyoming’s core energy industries, be assured we will continue to pursue this critical litigation in the federal courts,” Gov. Mark Gordon said in a prepared statement.

Noting the dissenting votes from Justices Kavanaugh and Gorsuch, Gordon added, “We can hope the musings of the two justices who recognized the merits of our case will hold sway in a timely positive resolution of this challenge.”

The Biden administration, through its Clean Power Plan 2.0 initiative, revived an Obama-era policy, including measures referred to as the power plant rules. The EPA finalized four updated rules in April aimed at drastically cutting pollution from natural gas- and coal-fired electric generating facilities. The rules mandate utilities commit to reducing 90% of planet-warming carbon dioxide emissions from existing coal plants by 2032 if they plan to operate the facilities beyond 2039. Those plants would have to be retrofitted with carbon capture, utilization and sequestration technology — similar to a Wyoming mandate.

Though proponents of Wyoming’s mandate are hopeful the technology will extend the life of aging coal plants here and throughout its U.S. utility market, they don’t want the federal government to impose deadlines in case such retrofits need more time to reach economic viability. The heavy hand of such a federal policy, according to coal proponents, threatens to accelerate the contraction of Wyoming’s shrinking coal industry, which has been a bulwark of the state’s economy for decades.

Unlike other coal-producing regions in the U.S. that sell a different type of coal to steelmakers around the globe, Wyoming coal production is dependent almost entirely on U.S. customers that burn the commodity to generate electricity, making Wyoming’s industry particularly vulnerable.

Wyoming coal mines serve nearly half the nation’s coal-fired power plants.

“Regrettably, our utilities are still required to assume the regulations will be in effect until the lower courts rule, only increasing the uncertainty of their future,” Gordon acknowledged in prepared remarks.

Wyoming’s coal defense strategies

Wyoming joined 24 other states earlier this year in litigation alleging the EPA’s new rules ignore a 2022 U.S. Supreme Court ruling regarding the federal government’s authority over greenhouse gas emissions for power plants. In a second lawsuit, Wyoming and 22 other states allege the EPA’s new rules unlawfully target coal-power-plant emissions without properly justifying the rules’ health benefits or economic ramifications to coal-reliant communities.

For more than a decade, Wyoming has leveraged state, federal and private dollars to advance coal carbon capture, utilization and sequestration technology at the Integrated Test Center in Gillette. It’s perhaps the nation’s premier research facility to advance the technology toward commercial deployment, according to proponents, and one reason why the Wyoming Legislature felt confident imposing a carbon capture mandate on some coal plants in the state.

During Gordon’s administration, the Legislature has passed a series of laws mandating regulated utilities in the state that want to close coal-burning units to instead retrofit those plants with carbon capture or sell the facilities to a party willing to do so.

So far, however, Black Hills Energy and Rocky Mountain Power — the only two Wyoming utilities subject to the state’s mandate — have suggested such retrofits are not yet economically viable. Early estimates by the companies put the cost at $500 million to beyond $1 billion to retrofit each of the four coal-burning units now subject to Wyoming’s mandate. Those costs, based on Wyoming law, would be passed on to their customers in the state, who’ve already experienced significant rate hikes in the recent past.

Too far too soon?

In addition to addressing the climate crisis, the federal power plant rules are also intended to cement the existing trend of coal plant retirements, compelling utilities to speed up their transition to cleaner energy sources.

But there’s a growing chorus of concern among some power industry experts that the nation’s demand for baseload electricity — or continuous, “dispatchable” power availability derived from coal, natural gas and nuclear plants — is no longer stagnant. Rather, some industry analysts have modified forecasts to account for skyrocketing electrical demand to power data centers, artificial intelligence computations and the movement to electrify modern necessities such as vehicles.

For example, U.S. electrical demand could jump 15% by 2030, an unprecedented increase in modern history, according to a Wood Mackenzie report, leading some to suggest that the addition of renewable power generation — which is not available 24/7 — might not keep pace if coal plant retirements continue at the current pace.

“Intentionally making reliable and dispatchable energy needlessly more expensive will kill people,” Rep. John Bear (R-Gillette) told WyoFile via email. “That’s why we must fight back against these illegal rules promulgated by agencies who lack the constitutional authority to do so.”

Others note the Wyoming mining industry depends on an aging fleet of coal-fired power plants that are among the most expensive electrical generation facilities to operate in the nation. While forecasts for surging electrical demand have motivated utilities to delay scheduled retirement dates for some coal plants, those facilities will likely be relegated only to part-time use to meet peak seasonal demand, University of Wyoming energy economist Rob Godby said.

Increasing power demand, “is probably not going to avoid [coal plant retirements] for any significant length of time,” Godby said. “It may extend [Wyoming Powder River Basin] coal production a little bit longer. But broadly speaking, there’s still an awful lot of planned coal retirements in the works, and those are just unavoidable because we’re talking about plants that are so old.”

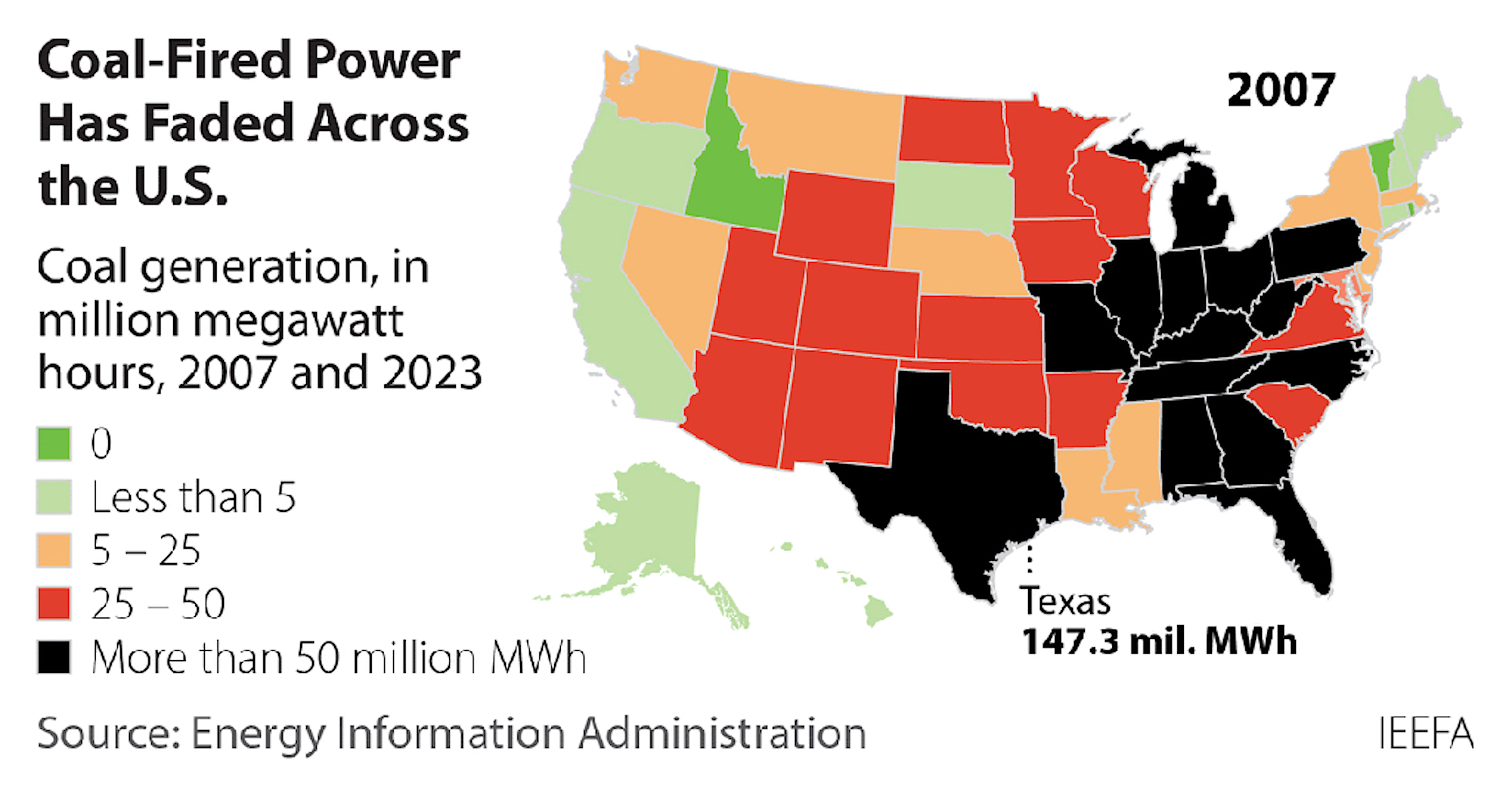

The energy research group Institute for Energy Economics and Financial Analysis also casts doubt on the notion that a surge in electrical demand might buy enough time for aging coal plants to retrofit them with carbon capture.

“We expect operating coal capacity to continue its steady decline for the remainder of the decade,” the group stated. “Even the remaining coal plants are likely to operate significantly less frequently, continuing another decade-plus trend that has seen the capacity factor (the amount of power produced divided by the maximum amount that could be produced over a given period) at operating coal plants fall steadily since 2011.”

Coal production in the western U.S. was down 24% during the second quarter of this year compared to the same last year, mostly due to flush stockpiles at coal-burning utilities, according to the U.S. Energy Information Administration.

WyoFile is an independent nonprofit news organization focused on Wyoming people, places and policy.

This story was posted on October 22, 2024.