Rocky Mountain Power wants to hike electric rates again, this time by $116M

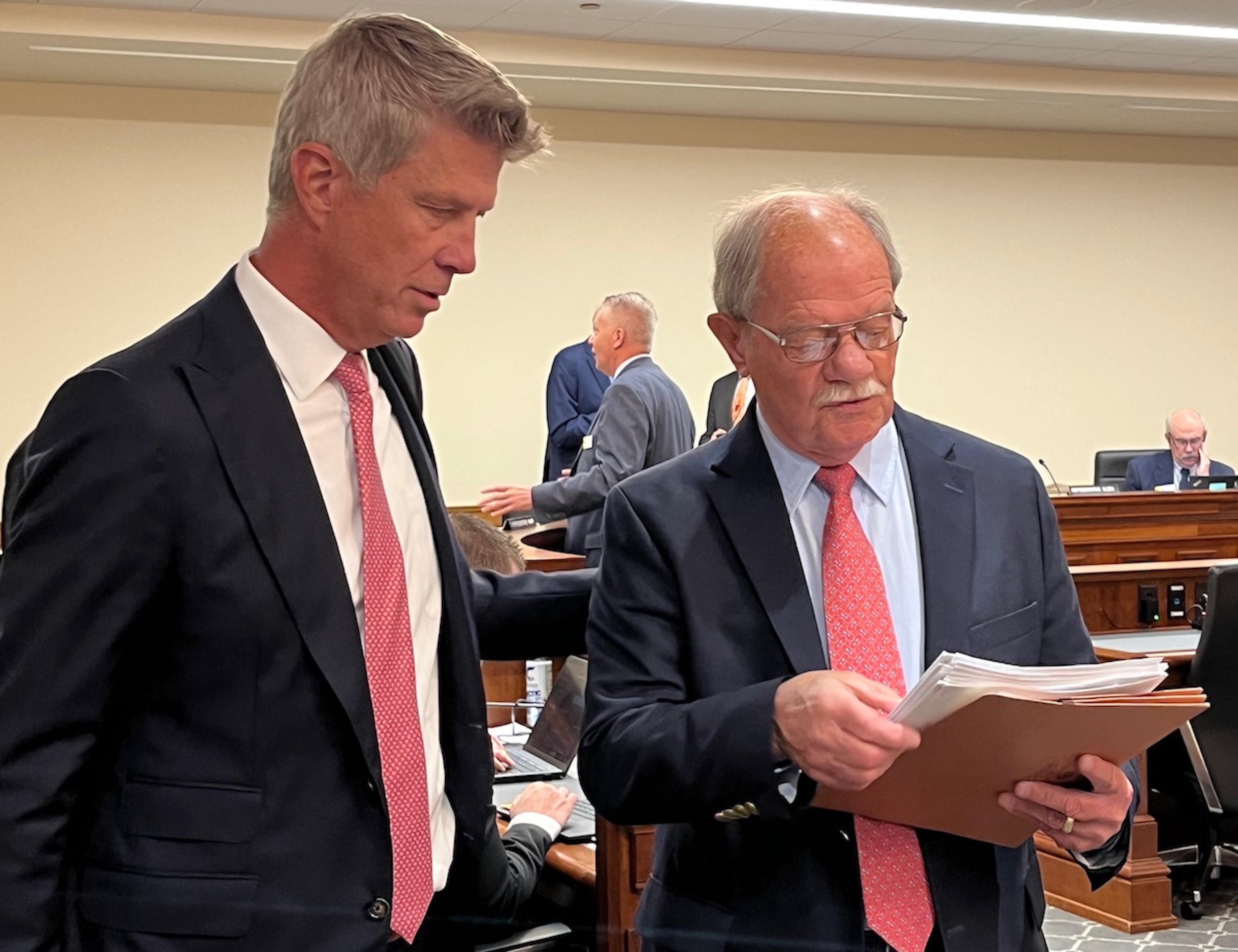

Rocky Mountain Power President and CEO Gary Hoogeveen goes over notes with lobbyist Rick Kaysen during a Corporations, Elections and Political Subdivisions Committee hearing in Cheyenne Sept. 20, 2023. (Dustin Bleizeffer/WyoFile)

WYOFILE:

The utility says its Wyoming customers owe $86.4 million due to unforeseen coal, natural gas and power purchase costs in 2023.

If you’re one of Rocky Mountain Power’s 144,511 customers in Wyoming, your monthly electricity bill may soon increase — again.

For the second year in a row, the utility — a division of Warren Buffet’s PacifiCorp — says it underestimated costs for coal and natural gas to fuel power plants and to buy electricity on the open market, and it wants to tap Wyoming ratepayers to make up the difference.

Rocky Mountain Power on Monday filed for a 12.3% rate increase that — if approved — would tap Wyoming customers for a one-time $86.4 million, mostly due to higher-than-expected fuel costs in 2023. If Wyoming regulators approve the full amount, the company’s typical residential customer will experience a 9.3% increase, or about $12 more to their monthly bill, beginning July 1 and lasting for 12 months, according to Rocky Mountain Power.

The utility’s large industrial customers in the state — trona mines, oil and natural gas refineries, for example — consume about 70% of the electricity it provides in Wyoming and would pay a higher percentage, according to filings with the state.

In another request filed earlier this month, Rocky Mountain Power is asking permission to cancel a ratepayer credit derived from the President Donald Trump-era Tax Cuts and Jobs Act because it is set to expire, resulting in another 4.2% hike, or about $29.9 million.

That’s not all.

The Wyoming Office of Consumer Advocate says it expects the utility may file yet another “general rate” hike in May or June, although Rocky Mountain Power has not spoken publicly on the potential.

The latest series of potential rate increases — all of which are subject to approval by the Wyoming Public Service Commission — comes just months after state regulators ruled on a pair of high-profile and highly criticized Rocky Mountain Power rate increase requests that last year struck fear into the hearts of low-income residents and rankled local and state officials.

Annual fuel cost adjustment

Like many other regulated utilities, Rocky Mountain Power is allowed to balance its estimated-versus-actual costs for fuel commodities and power purchases from the previous year. Sometimes that results in a rebate to customers and sometimes a one-time extra charge, typically spread out over a year.

Whether it’s a rebate or a catch-up charge, the “energy cost adjustment mechanism” splits the difference 80/20 between customers and the utility. (Last year, the utility proposed a cost share of 100/0, which was rejected. The Legislature recently passed a law prohibiting a 100/0 “cost sharing band.”)

Rocky Mountain Power says its estimate for coal, natural gas and power purchase costs in 2023 fell short, and its Wyoming customers — factoring in the 80/20 liability split — owe $86.4 million.

“We recognize that in difficult economic conditions, a price increase is not good news,” Rocky Mountain Power Senior Vice President for Regulation and Customer and Community Solutions Joelle Steward said in a prepared statement. “Despite these difficulties, we remain committed to bringing the best value to our customers for their hard-earned dollars.”

Declining U.S. coal production, along with increased U.S. coal exports to Europe due to the war in Ukraine, forced Rocky Mountain Power to rely more on natural gas-fueled power generation and wholesale power market purchases in 2023, according to the company.

The company also had to pay top dollar to replenish coal stockpiles at its coal-fired power plants, it said.

“Due to overall lower coal resource output, the company had to adjust its overall system operations through increased natural gas power plant output, reduced market sales and increased market purchases,” PacifiCorp’s Net Power Cost Specialist Jack Painter said in a prepared statement. “In 2023, all of PacifiCorp’s Utah coal suppliers and one major Wyoming coal supplier made emergency contract declarations that resulted in significant delivery shortfalls of PacifiCorp’s contracted coal supply.”

Coal market challenges last year were exacerbated by a fire at the Lila Canyon coal mine in Utah, the company said.

Back-to-back rate hikes

Last year, Rocky Mountain Power proposed a $50.3 million fuel cost adjustment based on cost overruns in 2022. It also asked to raise its continuing “general rate” — which covers larger system-wide operational costs — by $140.2 million for a combined 29.2% increase.

The historic request resulted in an outcry from Rocky Mountain Power customers and local officials, and it inspired Wyoming lawmakers to pass five new laws empowering the Public Service Commission to more closely scrutinize electric utility investments that can be passed on to Wyoming ratepayers.

After several months of public meetings and a long, courtroom-like hearing in October, state regulatory authorities approved an 8.3% general rate increase rather than the 21.6% requested, and allowed the company to tap ratepayers for a one-time fuel cost adjustment.

Rocky Mountain Power then attempted to relitigate portions of the 2023 case, hoping to add $32 million in charges that the state had denied just a few months ago. The three-person Public Service Commission panel on Thursday unanimously refused the request, commenting they were “offended” by one of the utility’s allegedly misleading arguments.

While the state significantly reduced the company’s proposed rate hikes in 2023, nothing prevents Rocky Mountain Power from coming back with new evidence of rising costs to potentially justify more rate increases, according to the Office of Consumer Advocate.

Although the agency is still reviewing the utility’s latest rate increase proposals, it’s likely it will intervene in the case, Consumer Advocate Administrator Anthony Ornelas said.

Wyoming Industrial Energy Consumers, which represents trona mines, oil and gas refiners and other large customers who make up 70% of Rocky Mountain Power’s electricity consumption in the state, says it will also ask to intervene in the case.

WyoFile is an independent nonprofit news organization focused on Wyoming people, places and policy.

This story was posted on April 17, 2024.