Report: Wyoming needs more affordable housing, but challenges differ by county

(2024 Statewide Housing Needs Assessment, WCDA)

FROM WYOFILE:

The Wyoming Community Development Authority’s analysis shows rental and mortgage rates outpacing wage increases in much of the state. Beyond that, counties face issues stemming from changing employment needs, demographics and population.

The story of Wyoming’s housing woes cannot be boiled down to one statistic, map or issue. If it could, the Wyoming Community Development Authority’s recent housing needs assessment wouldn’t need to be 300 pages long.

That said, one thing is clear: There’s a need for more and better affordable housing, said Scott Hoversland, executive director of the development authority.

“There’s a current need for almost 50,000 homes or some types of modifications,” he emphasized.

That’s because more than 50,000 Wyoming households at or below 100% area median income are overcrowded, lack adequate facilities or plumbing or cost more than local workers can comfortably afford, Hoversland said.

Additionally, Wyoming will need a larger, more diverse housing stock for the state’s changing employment landscape and to encourage future growth, the assessment found.

That translates to a need for between 20,700 and 38,600 new units in Wyoming between 2021 and 2030 for a range of income levels, report authors said.

At the same time, counties differ significantly in the challenges they face and the solutions they’ll need to bolster housing at the local level.

Break it down

The report shows that certain housing struggles are nearly ubiquitous, while others vary greatly across Wyoming. It found certain industries do pay enough for their workers to afford housing, but in some cases, those industries are shrinking in Wyoming. Meanwhile, other industries don’t pay enough for workers to afford a home without requiring them to overextend themselves financially.

For example, only in Carbon County can people in the leisure and hospitality industry earn an average annual wage and still afford median rent prices without being “cost burdened” — a term for when workers spend more than 30% of their income on housing.

Every other county’s rental prices have outgrown these employees’ ability to comfortably afford housing, even though the industry makes up around 14% of employment in the state.

Considering the median sale prices for houses — with a mortgage, interest and other home costs — very few industries pay enough to allow single people to buy a house without being cost burdened in Wyoming.

Meanwhile, the mining and natural resources industry — which does have a median income high enough for employees to buy houses in most of the state — saw a 31% decline in employment between 2010 and 2022.

Lower-paying industries like education and health services are on the rise, but workers in those fields struggle to afford housing, according to the report.

Beyond the overall trends, there are several key differences between counties.

While most counties are suffering — Johnson County arguably the most — others must be doing great because median wages are keeping up with median rent growth. But the truth is more complicated, and comparing just median income and median rent doesn’t paint the whole picture.

Hoversland sent this report to legislators around the state, he said, and some said it didn’t look like there was any issue.

“You can look at one specific thing, and it doesn’t look like a problem,” he said. “You may have enough homes, but then … you may have a lot of the service industry workers that are in your county, but they can’t afford either the rent or the homeownership.”

For example, in Hot Springs County, median income is growing faster than median rent — an indication that workers there can afford housing — but other stats don’t look so good.

The county’s poverty rate increased from 9% to 13% between 2010 and 2021, according to the report. Hot Springs is also projected to lose 6% of its population by 2030 while still needing between 40 and 204 new houses by then (depending on how many residences need to be replaced).

And while these median rent and income growth statistics are helpful, they don’t capture the experiences of those making far more and far less money.

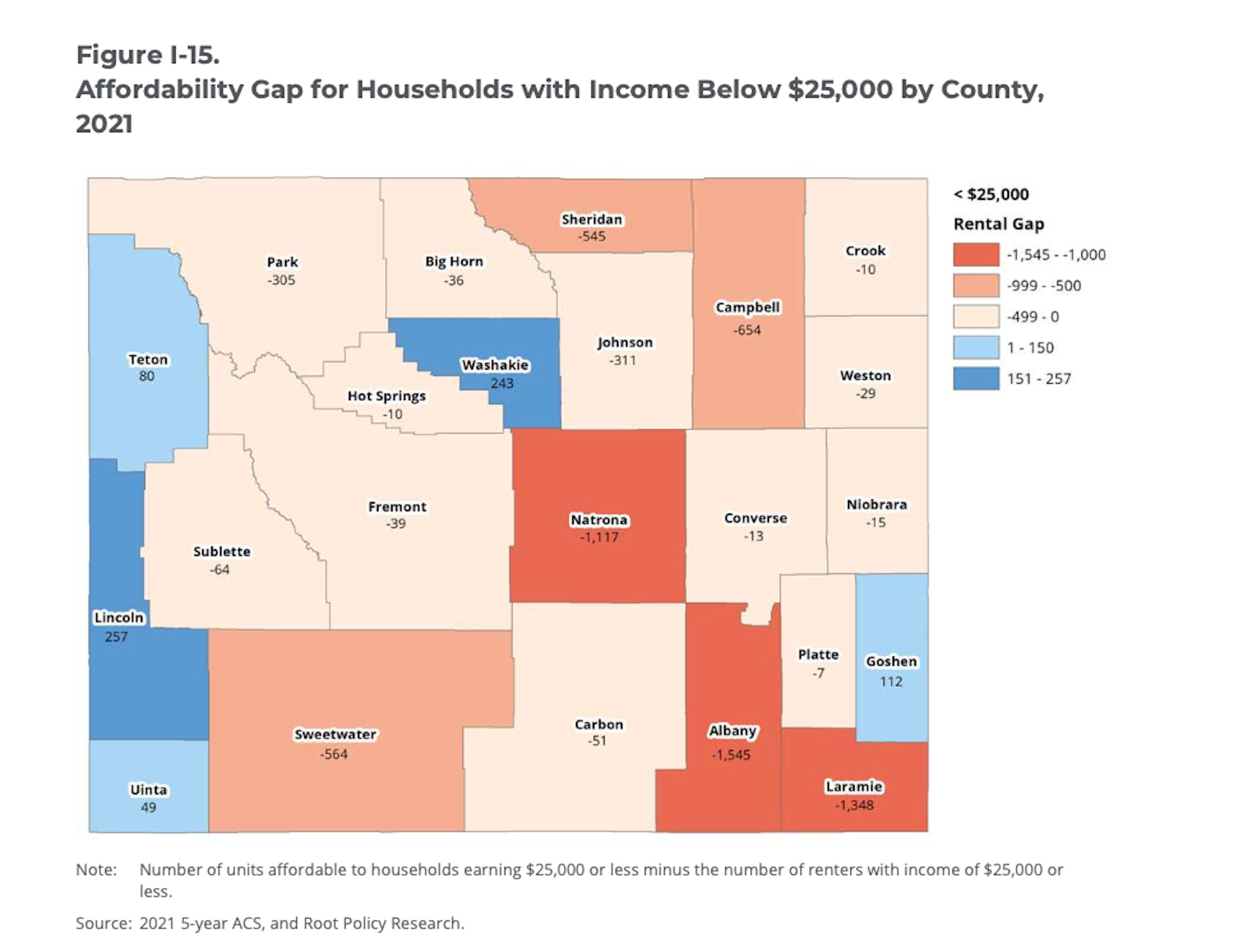

Just look at Albany County, where median income is reportedly keeping up with median rent. It’s also home to the state’s largest gap between rental needs and infrastructure for people making less than $25,000 a year.

And then there’s Teton County, which is its own thing.

Statistics may show a surplus of affordable housing for people earning less than $25,000 a year in Teton County, but the report states that this can be misleading given how many people making a low income relocated to live outside the county.

Beyond that, 60% of the housing that’s affordable for people making less than $35,000 a year is taken up by higher-income earners in Teton, Hoversland said.

“So even though there’s more available, the higher income renters are taking those,” he said.

All this is to say, housing issues are complicated and affected by several factors in each area. Planning for housing in Wyoming’s future will likely be just as complicated.

Next, stakeholders around Wyoming will create a strategic plan using this new data, Hoversland said. Forming over the next nine months, he said it will include the Wyoming Association of Municipalities, the Wyoming County Commissioners Association and the Wyoming Economic Development Authority, among others.

And then Hoversland expects outcomes and suggestions to go to the Wyoming Legislature.

The WCDA will also be publishing short, individual reports for each county and 99 communities around Wyoming in the near future.

To see the broader, initial report, go here.

WyoFile is an independent nonprofit news organization focused on Wyoming people, places and policy.

This story was posted on March 19, 2024.